Selling on marketplaces has never been as dynamic as during containment. Much has been said about a phenomenon of postponing physical sales to Marketplaces sales, but the scale of the phenomenon is unprecedented. Based on 450 sellers analyzed, 71% maintained a activity of sale via marketplaces during the period of confinement.

It has also been shown that during the Covid period, competition indicators by product category exploded, in particular in product categories historically subject to strong competition and which were highly acclaimed by the French during this period (toy games, home and DIY, computers, etc.).

Sales have literally skyrocketed, on virtually every marketplace – Amazon , Fnac , C-Discount , Rakuten , etc. – and in a large number of product categories.

The opportunity for us to measure the impact of our pricing systems in the creation of value and growth in an environment made even more competitive.

The positive impact of the health crisis on marketplaces sales

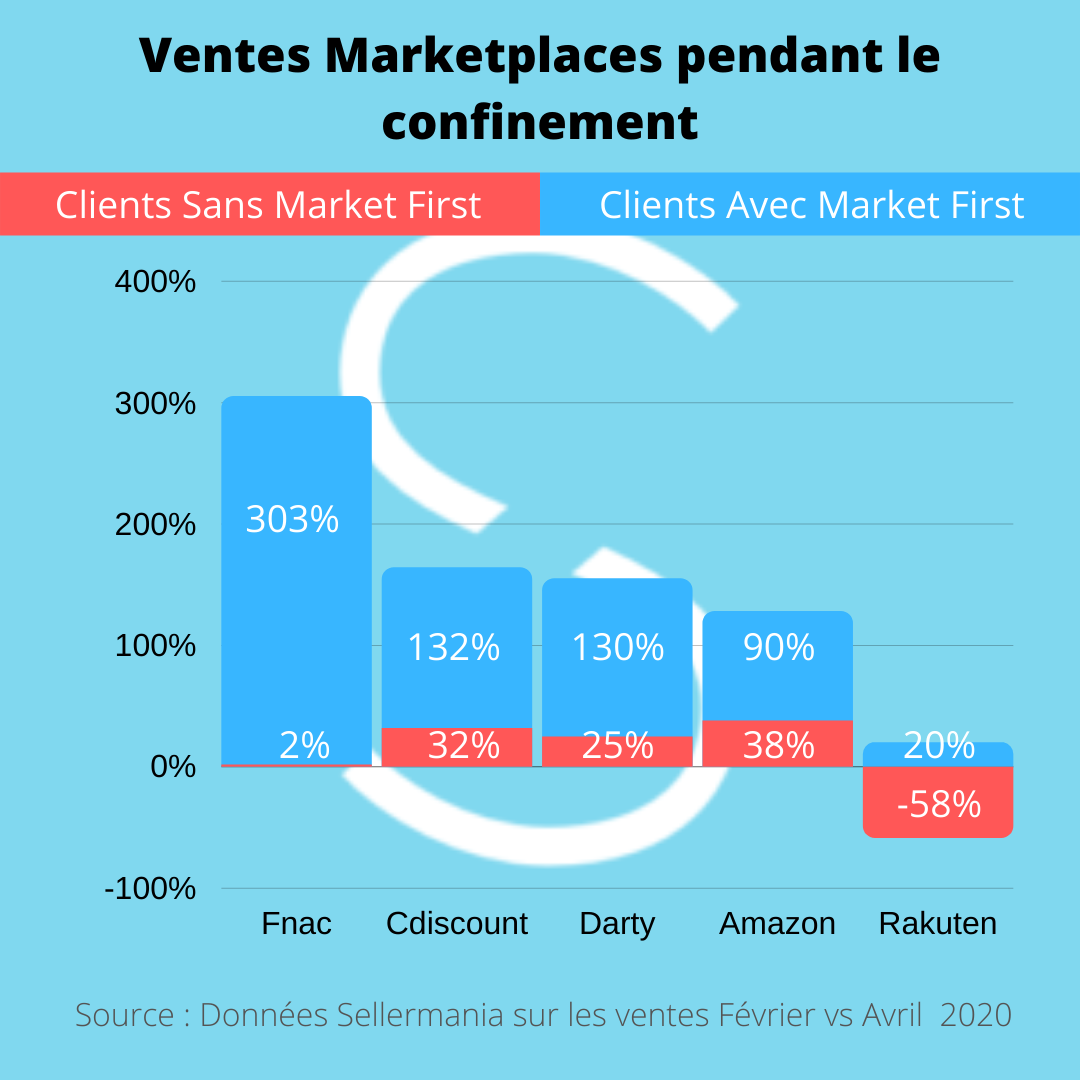

While growth is general on marketplaces, we find that professional sellers with our Pricing Market First feature greatly outperformed the performance sellers who do not have this functionality, with growth greater than 200% , compared to 40% for those who do not have this functionality.

All marketplaces affected by the increase in online sales during the lockdown

We have seen that sales were progressing on all sites, the top three coming from Mano Mano, Fnac and Darty who saw their sales explode.

COVID impact on Marketplaces sales slowed down by Amazon warehouse closures

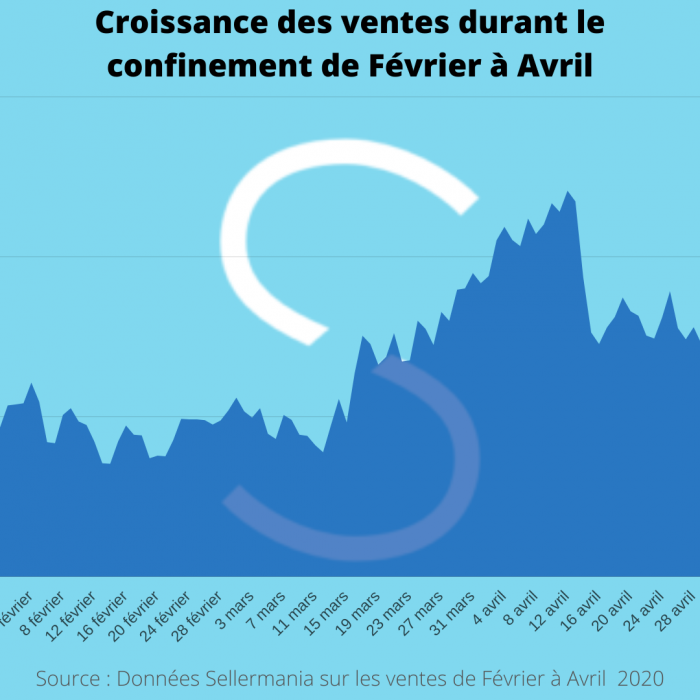

We can clearly see on this graph the strong progression from March 15 , first day of confinement. The observed fall April 15 is due to the condemnation of Amazon and the announcement of the closure of its warehouses .

Note that Amazon closed its warehouses on April 15 and was on a trend of + 179% before the closing announcement. Overnight, sales fell by around 40% before stabilizing, and resuming when it reopens on May 18.

The Fnac also announced a closing period from April 9 to 20, for editorial categories, which weighed on sales, which were very strong.

Sellers who ship their products themselves as opposed to those who use “ Fulfilled by Amazon »Are doing much better than the others, Amazon having closed its warehouses, and having announced that they stopped receiving goods from the start of containment.

Like what on marketplaces as elsewhere, it is better to avoid putting all your eggs in one basket!

Q1 2020 growth

This strong performance compares to overall e-commerce growth of 7.7% in the first quarter compared to last year (Fevad Q1 2020). According to FEVAD, the marketplace panel grew by 5.5% in the first quarter vs. last year, knowing that this panel does not include the Amazon marketplace, which nevertheless represents half of the marketplace market.

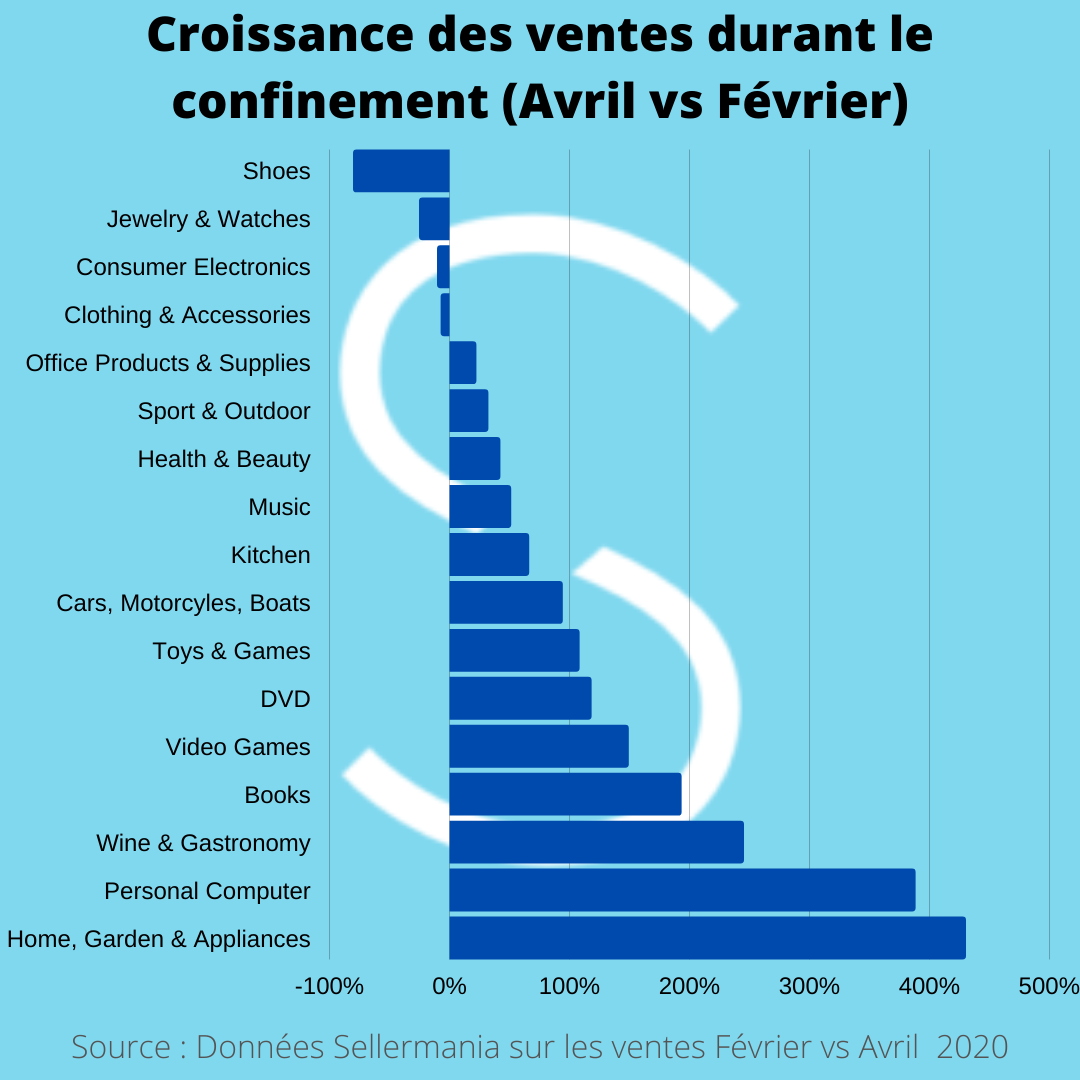

Almost all sectors are growing on marketplaces

Media, high tech and office products in mind, but not only.

We read that the categories that had recorded the most sales were:

-

- cultural products,

- video games,

- office automation such as ink cartridges, laptops and printers.

We found that many other sectors were also impacted:

-

- household appliances,

- decoration,

- gastronomy,

- games and toys,

- musical instruments.

Conversely, the high tech suffered, as did the fashion and the shoe .

Sellers with Market First feature 4x more growth than others

Almost systematically, sellers equipped with Market First , our dynamic pricing functionality , recorded a much better performance than those without this functionality.

It is on Fnac, Darty and Amazon that the impact is the most striking

Several reasons are identified :

- The technology we use for these three marketplaces is the most successful and latest generation. Our pricing, especially on Amazon, is the fastest on the market and allows you to position yourself in seconds, much faster than any other system, which undoubtedly has a major impact on performance.

- Fnac and Darty seem to have benefited from a postponement of Amazon sales, following the closure of the American firm’s warehouses during a large part of the confinement.

A full-scale test for Market First, the fastest pricing on the market

This is not a surprise, but it is one of the first times that we have been able to objectively and scientifically measure the impact of pricing on sales. This period is like a real AB test , without being influenced by exogenous factors, promotions, sales, advertising investments. During the containment all the marketplaces, and all the sellers were in the same boat.

At the same time, average prices have increased by 15%

With competition scarcer during containment, prices increased by around 15%. This is the whole point of a tool like Market First, which not only makes it possible to lower prices under competition when it is relevant, but also to raise prices when there is less competition, preserving this made the sellers margin, and while winning the buy box.

Sellermania’s Market First function reinforces the positive impact on Marketplaces sales

The performance is impressive, Fnac sellers with pricing make more than 300% growth while those without the functionality hardly progress. On Amazon, it’s 90% growth, compared to 38% for those without pricing, and on Cdiscount, 132% growth versus 32% for those who do not have this feature.

Dynamic pricing turned out to be a determining criterion for success during confinement, when Chinese competition was less present, and where new places were to be taken.

Methodology of the study on the impact of the COVID-19 crisis on marketplaces sales with and without dynamic pricing.

The analysis was made by comparing sales for the month of April, at the height of the confinement, with those made in February, pre-confinement, and excluding sellers who put their accounts on vacation. We also exclude from the calculation a handful of sellers whose performance is so high with pricing that they skew the calculation upwards, not sufficiently representing an overall performance.

A trend of accelerating sales growth

Since the end of containment, sales have stabilized around 35% above pre-covid revenue, which suggests that covid has taken a new step forward. The covid seems to permanently position marketplaces in the e-commerce landscape, it should be noted that a certain number of retailers who distribute their products via vendorcentral have been severely impacted by the decision to close Amazon warehouses and seem to want to limit their dependence. by switching to the Marketplaces model which offers more freedom and flexibility.

Questions sur l'impact de la crise sanitaire COVI-19 sur les Ventes Marketplaces

COVID

The first lesson is that we are still in the early stages, and despite the growth that has already been seen in the past, there is still enormous potential.

With these extraordinary performances, marketplaces have confirmed themselves as an anti-crisis channel, which any distributor should consider in addition to their website or their network of physical stores. For sellers already registered on marketplaces, more than ever, it is essential to equip yourself with a pricing functionality like Market First , whatever your product category.

According to the study carried out by Sellermania from February to April 2020, growth was very strong as soon as the confinement was announced on March 16, 2020.

Depending on the sectors and marketplaces, growth over the period can go up to more than 500%.

The level of sales made on Marketplaces remains high after the crisis and the deconfinement. The health crisis will therefore have had a boosting effect on the Marketplace activity and that in the long term.